housing allowance for pastors 2022

Individual Income Tax Return or Form 1040-SR US. Therefore it is important to request your housing allowance and have it designated before January 1 so that it is in place for all of 2020.

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller Allowance Clergy Financial

Can the housing allowance resolution be adopted or amended mid-year.

. It is considered one of the best tax benefits currently available to Clergy because this portion of income can potentially be exempt from income taxes. Start with these quick videos. Only expenses incurred after the allowance is officially designated can qualify for tax exemption.

The housing allowance is the most important tax. The housing allowance exclusion only applies for federal income tax purposes. Under the current tax code you are required to pay SE income on your wages and the fair market value of the parsonage as explained here.

It is time again to make sure you update your housing allowance resolution. The housing allowance for pastors is not and can never be a retroactive benefit. All states except Pennsylvania allow a ministers housing expenses to.

They must pay Social SecurityMedicare tax on the entire compensation of 65000. Include any amount of the allowance that you cant exclude as wages on line 1 of Form 1040 US. Housing manse parsonage designation.

Housing Allowance for pastor. Many ministers miss out on potential savings because they dont understand all thats available and how to use it. Tax Return for Seniors.

According to tax law if you are planning to claim a housing allowance deduction actually an exclusion for the upcoming calendar year your Session is required to designate the specific amount to be paid to you as. In this situation that extra 1000 has to be included as part of your wages on line 7 of your Form 1040 US. Individual Income Tax Return.

So if youre receiving 5000 in a housing allowance and the fair market rental value of the home dips to 4000 you can only exclude 4000 from your gross income. The preferred way to do this is for the church councilboard to adopt a housing allowance resolution prior to each calendar year or prior to the arrival of a new pastor and record the resolution in the minutes of the meeting. In that case at most 5000 of the 10000 housing allowance can be excluded.

Housing Allowance For Pastors 2022. If you find that the lowest number is your designated housing allowance that. In order to determine how much of the Clergy Housing Allowance can be excluded.

Housing Manse Parsonage Designation. A pastors housing allowance must be established or designated by the church or denominational authority. But if your church has only designated 1450 a month for your housing allowance then thats the most you can claim.

Ministers housing expenses are not subject to federal income tax or state tax. If a clergys annual compensation is 65000 and their church has designated a housing allowance of 15000 they subtract that from their salary bringing their taxable income for federal income tax purposes to 50000. You may use the housing expenses to reduce the amount of SE tax on the parsonage as explained in this Turbo Tax link.

The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified organization. As far a making a choice on which one to pay I cant think. Pastoral Housing Allowance for 2021.

From the pastors gross income in that calendar year. Enter Excess allowance and the amount on the dotted line next to line 1. The payments officially designated as a housing allowance must be used in the year received.

Maximize your deductions now and learn what you need to do to keep housing allowance. The IRS allows a ministers housing expenses to be tax-free compensation to the minister when the church properly designates a housing allowance. 10 Housing Allowance For Pastors Tips.

The housing allowance for pastors is not and. Pastoral housing allowance for 2021. The Clergy Housing Allowance is a portion of a Ministers pay that has been designated to pay housing expenses.

If your mortgage payment is 2000 a month but you could only rent the home for 1500 then your housing allowance is limited to 1500 a month. Ministers Housing Allowance is a valuable lifelong financial tool if managed properly. If your mortgage payment is 2000 a month but you could only rent the home for 1500 then your housing allowance is limited to 1500 a month.

The housing allowance for pastors is not and can never be a retroactive benefit.

Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet The Pastor S Wallet

What Is The Minister S Housing Allowance Los Angeles Tax Attorney

Ministerial Housing Allowance Xpastor

Housing Allowance What You Need To Know The Better Way Planning Financial Support Why Is Planning Financial Support Important To Ensure Church Funds Ppt Download

Who Is Eligible For The Clergy Housing Allowance The Pastor S Wallet

What Is A Minister S Housing Allowance Who Qualifies

Ministers Housing Allowance Open Bible East

2022 Housing Guide Pdf Download Clergy Financial Resources

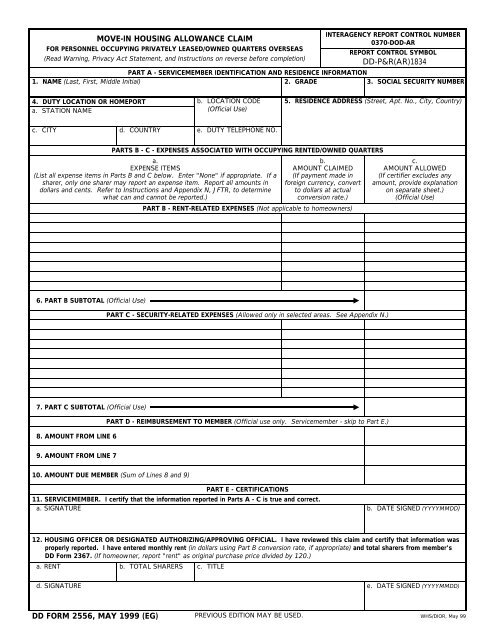

Move In Housing Allowance Claim Dd Form 2556 May

Video Q A Changing Your Minister S Housing Allowance The Pastor S Wallet

Housing Allowance For Ministers Leaderlab Uua Org

Benefits Of The Retired Clergy Housing Allowance In A Ccrc Mylifesite

Video Q A How Do You Get The Housing Allowance For A Pastor The Pastor S Wallet

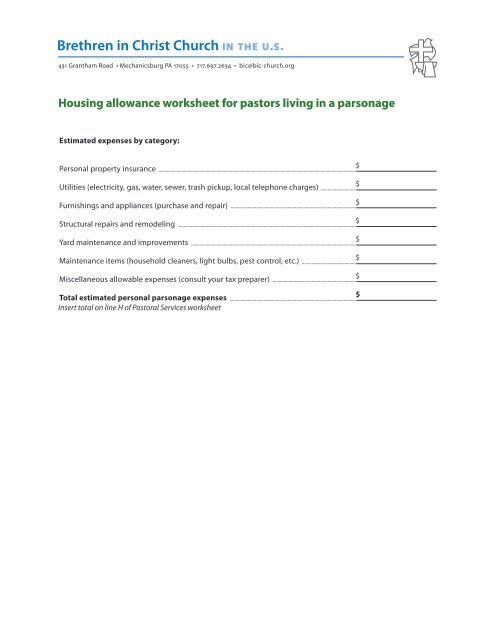

Housing Allowance Worksheet For Pastors Who Live In A Parsonage

Pastors Housing Allowance Worksheet Fill Out And Sign Printable Pdf Template Signnow

Clergy Housing Allowance Worksheet 2010 2022 Fill And Sign Printable Template Online Us Legal Forms

The Minister S Housing Allowance

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance Artiga Amy 9798621530662 Amazon Com Books

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance Kindle Edition By Artiga Amy Religion Spirituality Kindle Ebooks Amazon Com